Is Pinterest a buy?

- Luke Donay

- Apr 21, 2021

- 3 min read

It’s time to break down a growing social media name. Here is the breakdown on $PINS, otherwise known as Pinterest.

Current Price: $71.575

52/Wk High: $89.90

52/Wk Low: $15.82

Market Cap: $45.5 Billion

Read below for the breakdown!

Pinterest ($PINS) is a popular visual discovery platform that offers users the ability to create, share, and manage images related to themes.

Given Pinterest’s unique format, the e-commerce potential is immense, leading the company to build and maintain partnerships with e-commerce leaders such as Shopify.

Recently, Pinterest could be presenting an opportunity after a flat three months. While the name has been flat for the past few months, it is important to note that Pinterest has rallied over 309% throughout the past year.

Digging into the numbers, Pinterest beat Q4 2020 expectations with an EPS of $0.43, better than the analyst’s EPS consensus estimate of $0.32. On a year over year basis, EPS improved by 258.33%.

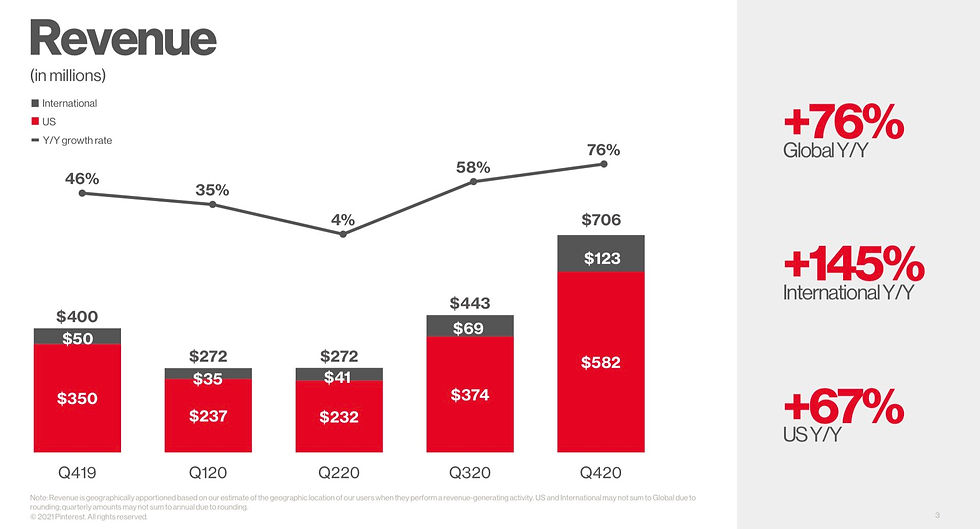

Revenues impressed as well, growing by 76% year over year to a strong $706 million. Breaking down revenue growth, the international segment experienced 145% growth year over year while the US segment expanded by 67% year over year.

Below is revenue broken down by segment for Q4 2020;

Global: $706 Million

United States: $582 Million

International: $123 Million

As for income, Pinterest reported a strong net income of $207.841 million, representing a 682% improvement in net income. For reference, the Q4 2019 net income totaled $-35.718 million.

On a non-GAAP basis, net income improved by 283% year over year to a strong $294.312 million. For reference, the Q4 2019 non-GAAP net income level was $76.866 million.

Shifting into Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) Pinterest reported a 287% improvement year over year, being Adjusted EBITDA to $299.182 million.

Taking a look at users global Monthly Active Users (MAUs) expanded by 37% year over year to a strong 459 million. Furthermore, MAUs expanded by 11% in the United States and 46% Internationally year over year.

Below is a breakdown of MAUs by segment;

Global: 459 Million MAUs

United States: 98 Million MAUs

International: 361 Million MAUs

As for Average Revenue Per User (ARPU), Pinterest reported a 29% jump in ARPU for Q4 2020. Furthermore, ARPU increased by 49% year over year within the United States segment while the International segment experienced a 67% improvement year over year.

Taking a brief look at FY 2020, Pinterest finished the year with $1.692 billion in revenues, representing 48% revenue growth on a year over year basis.

Furthermore, FY 2020 net income remained negative at $-128.323 million, but represents a 91% improvement over the FY 2019 net income level.

Management was upbeat about the quarter.

“Q4 capped a remarkable year of growth for Pinterest. Continued product innovation, execution and an earlier and longer holiday season helped us deliver 76% year-over-year revenue growth,” CFO Todd Morgenfeld said.

As for guidance, leadership is expecting Q1 2021 revenue growth to land with the low range of 70%.

Shifting into the balance sheet, the numbers are solid.

Total Debt: None

Total Liabilities: $367 Million

Total Assets: $2.609 Billion

Cash & Short Term Inv: $1.760 Billion

On a valuation basis, Pinterest does trade at a premium.

Forward Price to Earnings: 58.85x

Price to Sales: 30.73x

Price to Book: 20.36x

Price to Cash Flow: 54.29x

Management has done a solid job but could be more effective.

Return on Equity: -6.02%

Return on Assets: -5.13%

Return on Invested Capital: -5.55%

Given the numbers the analysts are bullish with a mean price target of $91.98/share, representing 29.29% upside.

The high price target is $107.50/share, representing 51.50% upside, while the low price target is $78.00/share, representing 9.64% upside.

The big money is quite involved as well with 71.01% of Pinterest being owned by institutions. Top holders include The Vanguard Group, BlackRock Institutional Trust, and Morgan Stanley Investment Management.

On a technical basis Pinterest could be presenting opportunity. According to the six-month charts the MACD recently turned to the downside within a range of 1.71 down to -.8416.

The six-month charts are also indicating and RSI of 39.34 and CCI of -57.8678, both of which are on the low end.

In short, Pinterest ($PINS) is a solid long term pick with expanding revenues, a growing user base, solid balance sheet, and huge e-commerce potential.

EAT - SLEEP - PROFIT

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Comentarios