Is this data industry company a buy?

- Luke Donay

- Sep 7, 2021

- 5 min read

It’s time to explore a cloud data leader. Here is the break down of $SNOW, otherwise known as Snowflake.

Current Price: $312.49

52/Wk High: $429.00

52/Wk Low: $184.71

Market Cap: $94.0 Billion

3 Month Performance: 24.84%

Read below for the break down!

Snowflake ( $SNOW ) is a major cloud data platform provider that enables clients to access a global network of governed data and provides companies with an all-in-one solution for data lakes, science, application, development, warehousing, engineering, and sharing.

Exploring the company’s platform, Snowflake's unique digital architecture that is based around a centralized data storage core provides solutions for a bevy of industries including Financial Services, Technology, Advertising, Media, Education, Entertainment, Healthcare, Public Sector business, Retail, and Manufacturing.

Furthermore, Snowflake’s data marketplace allows companies to access live data on the fly, driving new insights, reducing costs, and increasing efficiency.

On the flip side, the marketplace allows companies to monetize their data and offer data products and services to Snowflake's laundry list of customers, therefore increasing margins, expanding customer count, and improving customer experiences.

Digging into Snowflake's partners, the company maintains partnerships with the likes of Amazon Web Services (AWS), Google Cloud, Microsoft, Salesforce, Tableau, Sigma, BlackRock, Simon, Zoominfo, and more.

Shifting into the customer front, Snowflake boasts a strong line up of clients including DoorDash ( $DASH ), PepsiCo ( $PEP ), Dominos ( $DPZ ), Okta ( $OKTA ), Micron ( $MU ), Coupa Software ( $COUP ), Square ( $SQ ), Electronic Arts ( $EA ), and Capital One ( $COF ).

Rotating into leadership, Snowflake is led by CEO and Chairman Frank Slootman who provides over 25 years of experience within the enterprise software industry. Slootman boasts experience from the likes of EMC and Data Domain.

Sifting through management, the team is made up of reliable leaders who offer experience and wisdom from the likes of Oracle ( $ORCL ), EMC, Apigee, IBM ( $IBM ), Nvidia ( $NVDA ), Microsoft ( $MSFT ), and Google ( $GOOGL ).

In recent news, Snowflake launched the “Powered by Snowflake” program in which will provide partners the ability to create applications more efficiently, optimize performance, and drive awareness and adoption through marketing opportunities.

Leadership was upbeat.

“Based on their feedback, we developed the Powered by Snowflake program to make it even easier for software innovators to bring groundbreaking applications to market that redefine industry standards and supercharge business growth,” SVP of Product Christian Kleinerman said.

Shifting into the data world, the total volume of data to be created, captured, consumed, or copied is expected to reach over 180 zettabytes by 2025 on a global basis, representing sizable data growth over the 2020 global data volume level of 64.2 zettabytes (per statista.com).

Digging into the numbers, Snowflake ( $SNOW ) beat Q2 2022 earnings expectations with an EPS of $-0.04, better than the analyst’s EPS consensus estimate of $-0.15. On a quarter-over-quarter basis, EPS improved from a lower Q1 EPS of $-0.11.

Alongside EPS, revenues continued to expand with Q2 2022 total revenue coming in at $272.2 million, representing 104% revenue growth year-over-year.

Breaking down revenue by segment, product revenue totaled $254.6 million in Q2, representing 103% growth year-over-year. It is important to note that the professional services and other revenue segment delivered $17.575 million in quarterly revenue.

Furthermore, remaining performance obligations (RPO) totaled $1.5 billion at quarter-end, representing a strong 122% improvement year-over-year.

For the sake of education, RPO represents total future revenue that has not been recognized and includes deferred revenue and contracted revenues.

Rotating into revenue metrics, Snowflake reported a net revenue retention rate of 169% as of July 31st, representing a sizable improvement over the Q2 2021 level of 158%.

Do note, the net revenue retention rate (NRR) is a percent indicator of revenue collected from existing customers based on a specific time period, which is two years in Snowflakes case.

On the profit front, Snowflake reported a gross profit of $166.077 million in Q2, representing a strong improvement over the Q2 2020 level of $82.699 million.

While Snowflake did report a solid expansion in gross profit the company continued to run an operating loss of $-200.141 million, representing a worsening operating loss from the Q2 2020 level of $-77.683 million.

The company’s net loss also continued to grow larger with net loss totaling $-189.719 million throughout the quarter. Note, Snowflake reported a Q2 2020 net loss of $-77.634 million.

Finally, non-GAAP adjusted free cash flow (FCF) improved to $2.812 million in Q2, representing a significant improvement over the same time 2020 level of $-44.016 million. Do note, free cash flow margin improved from -33% to -4%.

On the customer front, Snowflake added 1,873 customers year-over-year, representing 60% customer count growth and bringing total customers at the end of the quarter to 4,990.

Digging deeper, Snowflake reached 116 customers with over $1 million in product revenue, representing 107% growth or 60 additions year-over-year.

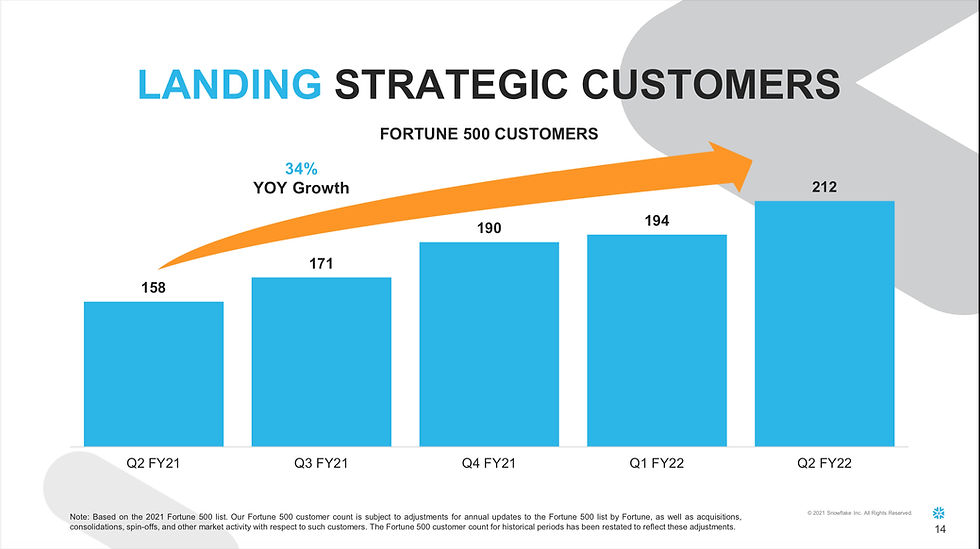

Lastly, Fortune 500 customers expanded by 34% year-over-year to a strong 212 customers, a huge improvement over the slim 158 Fortune 500 customers in Q2 of 2021.

Leadership was positive about the quarter.

“Snowflake saw continued momentum in Q2 with triple-digit growth in product revenue, reflecting strength in customer consumption,” Slootman said.

Looking to the future, leadership is bullish, expecting Q3 2022 product revenue to land within a range of $280 million to $285 million, representing 89% to 92% growth year-over-year.

Not only is leadership bullish heading into Q3, the company expects FY 2022 product revenue to land within a range of $1.060 billion to $1.070 billion, representing 91% to 93% growth.

Shifting into the balance sheet the numbers are solid.

Total Debt: None

Total Liabilities: $1.067 Billion

Total Assets: $6.032 Billion

Cash & Short Term Inv: $4.135 Billion

On a valuation basis, Snowflake does trade at a premium.

Price to Sales: 107.62x

Price to Book: 18.73x

Management could be more effective in the years to come.

Return on Equity: -35.27%

Return on Assets: -20.37%

Return on Invested Capital: -24.88%

Given the numbers the analysts are neutral with a mean price target of $311.00/share, representing -0.48% downside.

The high price target is $375.00/share, representing 20.00% upside, while the low price target is $240.00/share, representing -23.20% downside.

The big money is quite involved with 61.42% of Snowflake being owned by institutions. Top holders include ICONIQ Captial, Altimeter Capital Management, and Morgan Stanley Investment Management.

On a technical basis, Snowflake has been on the move. According to the six-month charts, the MACD is moving with significant upside momentum within a range of 10.66 down to 8.77.

The six-month charts are also indicating an RSI of 67.49 and CCI of 129.76, both of which are on the high end.

Exploring investor sentiment the bears believe Snowflake’s high valuation and sizable competitors are reasons for downside in the future.

Meanwhile, the bulls believe Snowflakes leading technology and platform, successful partnerships, and expanding customer list indicate positive future growth.

In short, Snowflake ( $SNOW ) is leading the data industry and a solid long-term bet with expanding revenues, a growing customer base, a reliable management team, a cutting edge platform, an accelerating data industry, and a bevy of mega partnerships that will bolster growth.

EAT - SLEEP - PROFIT

Disclaimer: This is not direct financial advice, simply an opinion based on independent research. Luke Donay does hold options contracts on Snowflake $SNOW.

Comments