Is this fintech darling a buy?

- Luke Donay

- Apr 20, 2022

- 10 min read

It’s time to explore a popular fintech name. Here is the deep dive into $SOFI, otherwise known as SoFi Technologies.

Current Price: $7.41

52/Wk High: $24.95

52/Wk Low: $7.05

Market Cap: $6.0 Billion

Dividend: None

Read below for the deep dive!

From booming to now bust, fintech stocks have been tumbling with names such as Paypal, Square, and SoFi all falling beyond 50% within just the past year.

The once “cutting edge” disruptors are getting pummeled day by day without relent as fear and frustration takes over the psychology of the market.

While fintech gets nailed one question remains, what do the fundamentals tell the average investor, and is a name such as SoFi worth taking some risk on given its most recent declines.

SoFi Technologies ($SOFI) is a fintech darling providing customers with digital financial services via its online and mobile platform that serves as a one-stop shop for the average consumer looking to manage their finances.

Breaking down SoFi by structure, the company operates through three key segments; Technology Platform, Financial Services, and last but not least, lending.

Throughout those key operating segments lyes a bevy of revenue streams including loan, insurance, investment, and deposit products.

Digging into SoFi by segment, it is only right to kick things off with SoFi’s Technology Platform segment, which is primarily made up of Galileo. Acquired in May of 2020 for $1.2 billion, Galileo is a technology platform services provider to large financial and non-financial institutions.

In summary, Galileo provides clients application programming interfaces (APIs) and software services which are then used to build digital banking products, process payments, and issue credit cards.

Galileo's client base has been growing rapidly as well, reporting a strong 100 million accounts as of Q4 2021, representing 67% growth year-over-year. Furthermore, Q4 2021 marked the 11th consecutive quarter of greater than double-digit account growth.

Source: SoFi Investor Relations 2022

The segment generates revenues via two key fee structures called Technology Platform Fees and Program Management Fees. According to SoFi, the company earns Technology Platform Fees and or revenue through the “continuous delivery” of an integrated technology platform as a service via Galileo.

Furthermore, Program Management Fees are generated via card programs. Simply put, the transaction fee is a direct cause of the creation and management of card programs issued by enterprise partners or banks via Galileo.

It’s important to note that Galileo is more predictable in some aspects than other company segments, given that Galileo typically utilizes multi-year service contracts that are usually volume-based and require minimum monthly payments by the client.

Shifting into SoFi’s Financial Services Segment, the segment is made up of SoFi Money, SoFi Invest, SoFi Relay, and SoFi Credit Card. Breaking each product down, we will begin with SoFi Money.

SoFi Money, a key component of the Financial Services segment, is the company’s digital and mobile cash management account offering. This key product allows customers to manage cash accounts similar to that of your typical bank directly through the SoFi Platform.

Before moving into the next product of the segment, it is important to recognize SoFi’s recent Bank Merger, which will allow SoFi to transfer SoFi Money accounts over to SoFi Bank as true deposit accounts, instead of relying on member bank holding companies to produce cash management services.

The bank merger also allows SoFi to now offer transferred accounts under SoFi Bank not only checking and saving features but elevated interest rates, creating an only better customer experience.

Shifting into SoFi Invest, customers are provided access to a mobile-first investment experience, allowing users to purchase and trade stocks, ETFs, and digital assets within the same brokerage application.

Furthermore, via SoFi Invest the company offers Robo-advisory to clients and access to managed portfolios made up of stocks, ETFs, and bonds. Rounding out the Investment product, SoFi offers fractionalized stock trading and an IPO investment feature.

To round out the segment, SoFi also provides SoFi Credit Card, SoFi Relay, and SoFi Protect within their Financial Services segment.

In total, the Financial Services segment’s key revenue drivers include brokerage fees (including payment for order flow agreements), referral fees, enterprise service fees, net interest income, equity capital market fees, and payment network fees.

Rotating into last but not least, the company’s Lending segment. SoFi provides clients with lending services which include student, personal, and home loans.

Digging deeper, one of SoFi’s key focuses is student loan refinancing, coupled with in-school lending. Using SoFi, students have the ability to not only refinance loans but borrow funds while attending school, providing student clients with unique features.

Other lending functions SoFi offers include personal lending with a focus on debt consolidation and home improvement or home loans with a focus on agency and non-agency loans for members purchasing or refinancing a current mortgage.

Key to driving SoFi’s lending segment is their gain-on-sale model, in which SoFi originates loans via their platform and then sells them for a considerable gain to large financial institutions within their securitization and whole loan channels.

Concerning the segment, by securing a national bank charter, SoFi will now be able to “considerably” lower the cost of funding by utilizing member deposits held at SoFi bank to fund loans through the segment.

The national bank charter also allows SoFi to originate new loans within SoFi bank and enables the company to offer a vast array of loan sizes and interest rates.

Finally, the SoFi lending segment maintains the full lifecycle of the transaction, which includes credit application, underwriting, approval, funding, and servicing, allowing for a more efficient lending model.

Concluding SoFi’s structure is the company’s firm belief in what management calls the “Financial Services Productivity Loop”, leadership's core strategy.

Source: SoFi Investor Relations 2022

The strategy, centered around trust-building and lifetime relationships with customers, focuses on providing an ecosystem of financial services which in turn increases the chance of an existing user adopting other offerings and lowering member acquisition costs while increasing revenue per member.

Moving away from business strategy, SoFi is led by Chief Executive Officer Anthony Noto who previously served at Twitter as COO and CFO, Goldman Sachs as co-head of global TMT investment banking, and CFO of the NFL.

Behind Noto is a strong management team, boasting experience from the likes of Uber, Goldman Sachs, Intuit, Procter & Gamble, Amazon, Zynga, Citibank, and more.

Prior to digging into the financials, it is important to cover the major acquisitions and mergers SoFi has carried out in recent quarters.

Prior to acquiring Galileo in May of 2020, SoFi acquired 8 Limited for $16.1 million in April of 2020. The acquisition of 8 Limited, a Hong Kong based investment company, marked SoFi’s first foreign expansion.

Furthermore, SoFi continues to make strategic pushes to expand the foundation of the business, completing the important bank merger in February of 2022 as well as entering into a merger agreement with Technisys.

Source: SoFi Investor Relations 2022

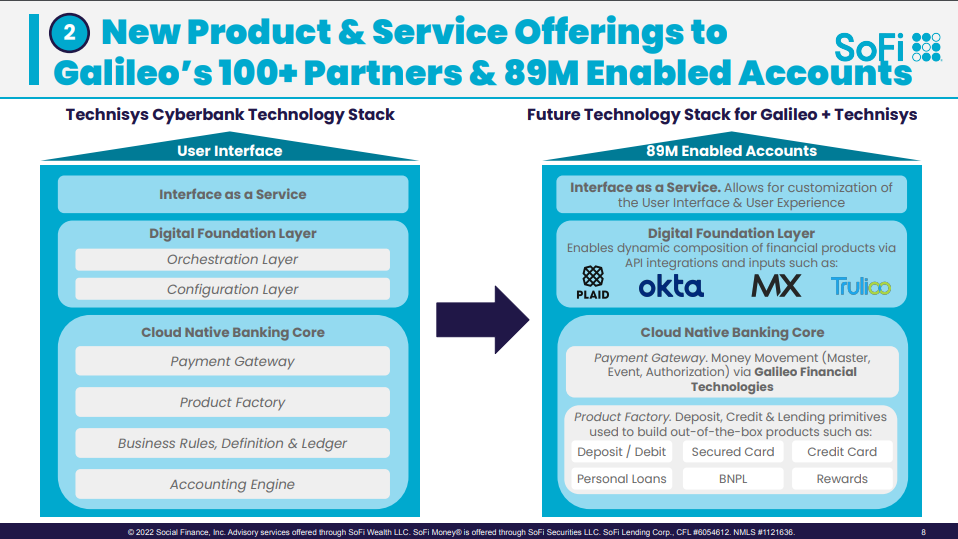

Digging deeper, SoFi completed the acquisition of Technisys in March of 2022, acquiring the company for $1.1 billion. Technisys is a cloud-native digital banking platform that maintains an already strong footprint made up of digital banks, established banks, and fintech companies in Latin America.

Source: SoFi Investor Relations 2022

By acquiring Technysis, management believes the company will enhance and complement Galileo through vertical integration and build on SoFi’s goal of building the “AWS of fintech” in the years to come.

Source: SoFi Investor Relations 2022

On a final note in regards to Technysis, leadership believes the acquisition will cumulatively add $500 to $800 million in revenue through year-end 2025 at significantly elevated incremental margins.

Moving into the financials, SoFi beat Q4 2021 expectations, delivering an EPS of $-0.15 compared to the analyst EPS consensus estimate of $-0.17.

Furthermore, EPS has been mostly without trend since SoFi went public, with the company reporting a Q2 EPS of $-0.48 and Q3 EPS of $-0.05.

On the revenues front, Sofi delivered fourth-quarter 2021 revenue of $280.9 million, representing 63.81% growth year-over-year. Furthermore, Sofi concluded FY 2021 with $977.3 million in revenue, representing 72.81% growth year-over-year.

On a quarterly basis, SoFi has been consistently delivering double-digit revenue growth.

FY 2020

Q4: 166.95%

FY 2021

Q1: 150.29%

Q2: 100.77%

Q3: 34.27%

Q4: 63.81%

Not only has SoFi been consistently delivering double-digit growth by quarter, but on a full-year basis, SoFi has delivered 87.49%, 37.63%, and 62.64% growth since 2018.

Shifting into income, SoFi reported a Q4 2021 net income level of -$111 million, representing a lower net income than the year’s prior level of -$82.6 million.

Furthermore, net income has remained consistently negative, with only one net positive quarter since FY 2019.

FY 2019

Q4: -$122.5 million

FY 2020:

Q1: -$106.4 million

Q2: $7.8 million

Q3: -$42.9 million

Q4: -$82.6 million

FY 2021

Q1: -$177.6 million

Q2: -$165.3 million

Q3: -$30 million

Q4: -$111 million

Continuing on the topic of income, SoFi delivered a Q4 2021 operating income level of -$106.7 million, representing a decline in comparison to the same time 2020 level of -$81.8 million.

Furthermore, below is SoFi’s track record on an operating income basis by quarter.

FY 2019

Q4: -$120.8 million

FY 2020:

Q1: -$102.4 million

Q2: -$86.1 million

Q3: -$42.4 million

Q4: -$81.8 million

FY 2021

Q1: -$174.3 million

Q2: -$144.2 million

Q3: -$28.6 million

Q4: -$106.7 million

In concluding commentary on operating income, it is important to note that operating income has continued to trend negative on an annual basis, with FY 2021 operating income totaling -$453.8 million.

Alongside expanding revenues, SoFi continues to grow gross profits, delivering a Q4 2021 gross profit of $211.7 million. In comparison to the same time 2020 level of $118.5 million, gross profit continues to trend positive.

SoFi has delivered gross profit growth eight consecutive quarters in a row, all of which represented at a minimum double-digit expansion.

Below is a FY 2021 breakdown by quarter of gross profit growth (YoY).

Q1: 203.24%

Q2: 131.38%

Q3: 34.27%

Q4: 78.70%

Analyzing gross profit on an annual basis, gross profit has been consistently improving since 2018, with FY 2021 gross profit totaling $720.3 million in comparison with the FY 2020 level of $386.6 million.

Shifting into margins, gross profit margins have been on the path of consistent improvement. As of the latest reported quarter, SoFi’s gross profit margin sat at 75.37%, better than the same time 2020 level of 69.09%.

Below is a breakdown of SoFi’s gross profit margin by quarter.

FY 2019

Q4: 49.78%

FY 2020:

Q1: 58.29%

Q2: 63.98%

Q3: 74.19%

Q4: 69.09%

FY 2021

Q1: 70.63%

Q2: 73.73%

Q3: 74.19%

Q4: 75.37%

Rounding out margins, net income margin, the net after-tax income of a company, remains negative with a Q4 2021 reading of -39.52%, better than the same time 2020 level of -48.18%.

Concluding broad financial metrics, adjusted EBITDA reached positive readings consistently in FY 2021. As of Q4 2021, SoFi delivered an adjusted EBITDA of $4.593 million.

Do note, that the Q4 adjusted EBITDA represented a decline year-over-year when compared to the same time 2020 level of $11.817 million but an improvement over the same time 2019 level of -$101.004 million.

On an annual basis, adjusted EBITDA totaled $30.221 million in 2021, representing a significant improvement over the FY 2020 level of -$44.576 million.

Pushing into company-specific metrics, member count continues to significantly expand, with total members growing by 87% year-over-year in 2021.

Source: SoFi Investor Relations 2022

Before digging deeper, do note that SoFi defines a member as a user who maintains a lending relationship with SoFi through either origination or servicing, has opened a financial services account with SoFi, or one who has signed up for a number of SoFi’s financial products.

As of the fourth quarter of 2021, SoFi reported having 3.460 million members, representing 17.8% growth in member count quarter-over-quarter and 87% expansion year-over-year.

Below is year-over-year member growth by quarter.

FY 2020

Q1: 54.3%

Q2: 58.6%

Q3: 73.8%

Q4: 89.5%

FY 2021

Q1: 110%

Q2: 112.6%

Q3: 95.7%

Q4: 87%

Alongside members, total products continue to grow rapidly. In fact, total products expanded by 105% year-over-year to 5.173 million products in FY 2021.

Source: SoFi Investor Relations 2022

Note, total products is defined by SoFi as “the aggregate number of lending and financial services products that our members have selected on our platform since our inception”, which is reported quarterly.

Furthermore, total products have expanded year-over-year by at least double digits every quarter since FY 2019 to present consecutively, representing an exponentially expanding and adopted platform.

On a final note, total lending products expanded by 17.6% year-over-year, while financial services products grew by 154.9% year-over-year as of Q4 2021.

Source: SoFi Investor Relations 2022

Expanding on the financials segment by segment, SoFi’s lending segment delivered $738.323 million in FY 2021 revenue, representing a 54% increase year-over-year. Furthermore, the segment delivered $399.607 million in contribution profit, representing a 65% increase year-over-year.

Moving through segments, the Technology Platform segment delivered $194.886 million in revenue throughout FY 2021, representing growth of 102% year-over-year. Furthermore, segment contribution profit totaled $64.447 million, representing 20% growth year-over-year.

Rounding out segment commentary, the Financial Services segment delivered $58.078 million in FY 2021 revenue, representing 389% growth year-over-year. Furthermore, segment contribution loss totaled $134.918 million, 2% worse year-over-year.

Touching on cash flows, FY 2021 net cash used in operating activities totaled -$1.350217 billion, representing a significantly larger net cash used level in comparison to the FY 2020 level of -$479.336 million.

Furthermore, FY 2021 net cash provided by investing activities totaled $110.193 million while net cash provided by financing activities totaled $684.987 million.

For perspective, FY 2020 net cash provided by investing activities totaled $258.949 million while net cash provided by financing activities totaled $853.754 million.

Looking ahead, SoFi was recently forced to lower full-year adjusted net revenue and EBITDA expectations on the back of the Biden Administrations' extension of the Federal Student Loan Payment Moratorium.

As a consequence, SoFi now expects FY 2022 adjusted net revenue of $1.47 billion and adjusted EBITDA of $100 million, representing a decline from previous guidance of $1.57 billion and $180 million respectively.

On a quarterly basis, SoFi maintained Q1 2022 guidance, expecting revenue to land within a range of $280 million to $285 million while maintaining a Q1 adjusted EBITDA range of $0 to $5 million.

In reference to the reduced guidance, leadership made some intriguing points.

“SoFi remains incredibly well positioned to drive continued strong growth in revenue, members, and products, along with continued and improving profitability, despite the fact that our student loan refinancing business has operated at less than 50% of pre-COVID levels for the last two years,” CEO Anthony Noto said.

Shifting into the balance sheet, SoFi maintains a well-balanced financial mix as of Q4 2021.

Total Assets: $9.1763 Billion

Total Liabilities: $4.4786 Billion

Total Debt: $4.1955 Billion

Cash & Cash Equivalents: $494.7 Million

Moving away from the balance sheet, SoFi’s valuation has been rapidly shrinking in recent months with a current price to sales of 6.9 times and price to book of 1.4 times, both of which are below Q4 2021 levels of 9.5 times and 2.1 times respectively.

Below is a breakdown of multiples since Q2 of 2021.

Price to Sales

Q2: 17.4x

Q3: 19x

Q4: 9.5x

Price to Book (LTM)

Q2: 3.3x

Q3: 3.9x

Q4: 2.1x

Price to tangible Book Value

Q2: 4.6x

Q3: 5.4x

Q4: 3.0x

On the analyst front, SoFi currently sits with 8 buy ratings and 6 hold ratings coupled with an average price target of $14.65/share, representing a nearly 100% upside from SoFi’s current price.

Furthermore, the high price target is $22.00/share, and the low price target is $10.00/share, representing upside returns if either target is achieved.

Shifting into fund exposure, SoFi is held by 53 ETFs which equate to 6.36% ownership and a market value of roughly $429.2 million. Furthermore, SoFi was held by 343 funds as of March 2022 per Marketsmith, with institutional ownership totaling 22%.

On a technical basis, SoFi remains within a consistent downtrend since the end of 2021, falling from a high of $28.26 to $6.97 over roughly 440 days.

Furthermore, weekly MACD momentum remains negative coupled with a nearly oversold RSI reading of 32.47.

Summarizing sentiment, the bulls argue SoFi is just getting started given its sticky business model, recent bank merger, and strong growth despite a core segment operating at 50% capacity that will eventually return in strength.

On the flip side, the bears argue SoFi is just another fish in the sea of digital banking services that lacks a true edge within the fintech space coupled with a possibly slowing economy and weaker consumers in the years ahead.

In short, SoFi maintains a unique business model, using an ecosystem of services to lower customer acquisition costs while increasing revenue per user.

Couple a unique business model with solid management, a strong balance sheet, a bank merger, and a pattern of adoption and growth, the long-term potential is surely recognizable for this fintech name.

EAT - SLEEP - PROFIT

Disclosure: This is not direct financial advice, simply an opinion based on independent research.

Comentários